The construction industry saw the number of job openings grow in August, but the industry is focused on how to fill the positions that already exist. Companies are instating better incentives, offering higher pay and embracing technology to attract qualified candidates, but industry officials argue more needs to be done to promote the industry and prepare qualified applicants to enter it.

The Jobs Are Out There

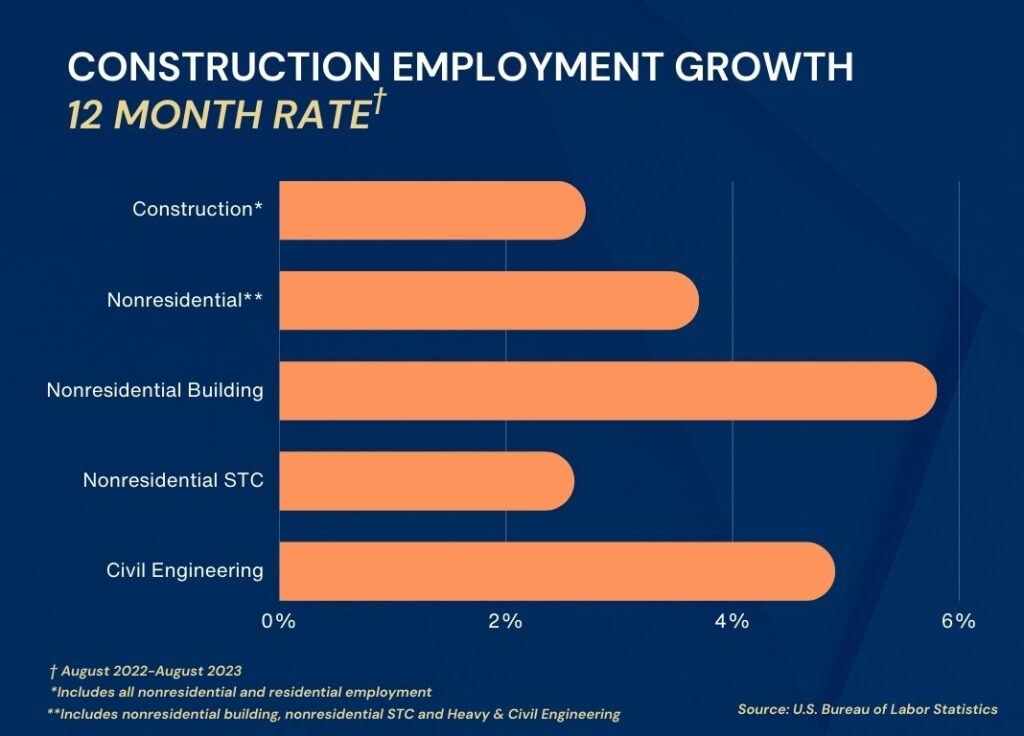

The U.S. Bureau of Labor Statistics (BLS) reported 22,000 new construction jobs for the month of August, ranking it among the top growth industries for the month. Looking geographically, from July 2022 to July 2023, Associated General Contractors (AGC) states that 45 states and the District of Columbia added construction jobs; 32 states and D.C. saw an increase in construction jobs from July to August of 2023. According to The Washington Post, the jump in positions and the continued resiliency of construction employment can be traced –– at least in part –– to a spike in infrastructure spending aimed in particular at jobs in green energy and sustainability. Additionally, legislation like the CHIPS Act –– which allotted tens of billions of dollars for advanced semiconductor manufacturing –– is poised to influence construction employment for years to come, says PBMares.

However, projections from BLS temper the enthusiasm somewhat, as they forecast 4% growth by 2032, which is “about as fast as the average for all occupations.” Employment growth in construction is not expected to be equally distributed, either, per BLS, with some specializations anticipating a reduction in demand due to changes in the way buildings are constructed, including a rise in preference for prefabricated components. Primarily, BLS expects this decline to affect brickmasons and related trades as well as carpenters and electricians.

Labor Shortage Comes Down to Qualifications, Say Firms

Still, companies continue to create construction jobs in response to increased demand, but that doesn’t mean they are able to fill all the positions –– at least not with job seekers who have the qualifications sought by companies. A report by AGC and Autodesk, presented earlier this month, indicated that nearly 90% of firms surveyed are facing challenges to filling open positions, especially craft jobs that make up the majority of work on site. According to Equipment World’s Ryan Whisner, 4.4% of jobs in the industry remain unfilled, and construction unemployment is at 3.9%, slightly higher than the overall August rate of 3.8% but notably higher than June of this year when construction unemployment was at 3.6%.

AGC and Autodesk’s 2023 Workforce Survey also examined the reasons for the discrepancy between available jobs and qualified candidates. At the top of their list of concerns, 68% of companies surveyed cited a lack of qualified candidates to fill the positions, which AGC and Autodesk assert “highlight significant shortcomings in the nation’s approach to preparing workers for careers in construction.”

Per Associated Builders and Contractors (ABC) chief economist Anirban Basu, the sheer size of projects is also impacting the ability of firms to find enough talent to fill their rosters. He points to manufacturing centralization efforts in states like Ohio, New York, Arizona and Texas –– where projects often carry price tags in the multiple billions. Basu told Construction Dive, “These projects are enormous, which means there is an outsized demand for subcontractors and workers. Just trying to amass that much talent at one time in one place is very expensive.”

Basu’s perspective only augments the concerns shown by AGC survey respondents. Megaprojects like those described by Basu require the same skills as smaller projects, which leaves firms of all sizes tapping the same candidate pool. Moreover, the specialized conditions required for building these megaprojects means qualifications may be more significant or tailored to unique specifications like “hyper clean spaces” or environmental flexibility.

In addition to available candidates lacking essential skills for the open positions, a quarter of firms reported a need for flexibility in scheduling or an option for remote work as a reason candidates were not fit for open positions, as the work requires employees to be at the site of the project. Lack of reliable transportation and inability to pass drug screenings also ranked among the top reasons firms have had trouble filling jobs.

Industry Must Meet New Candidates Where They Are

Bill Ryan of Dick Anderson Construction pointed to the shift in worker priorities and motivations as part of the disconnect between hiring managers and qualified candidates. Forces that drive young workers today are different from previous generations, and firms must be open to shifting their culture to meet those workers where they are. It’s important to younger workers that they will be heard and represented within the profession. A National Institute of Building Sciences report found that younger workers and women placed a high value on diversity in the built environment, actively seeking opportunities to work with teams made up of professionals with a variety of backgrounds.

AGC and Autodesk survey respondents were not entirely discouraged, however, as they continue to test new initiatives and approaches to attracting the workers they need. In terms of recruiting qualified talent, nearly two-thirds of respondents have upped their online recruiting strategies, and half of firms said they have reached out to younger prospects through career-building programs across the educational landscape.

Developing interest in construction alone is not a sufficient solution, as workers across industries continue to advocate for better incentives and conditions, especially since the pandemic. AGC’s respondents are no different, with the majority of firms having increased pay rates for positions and/or routed money into training and professional development. Other significant incentives cited by respondents include offering technology-based training and onboarding as well as lowering standards for hiring in terms of areas like education, employment history or arrest record.

Some experts like Dorsey Hager of Columbus/Central Ohio Building & Construction Trades Council and Greg Sizemore of Associated Builders and Contractors caution that large pay increases and other amenities used to attract skilled workers to positions may, in fact, exacerbate the workforce shortage. While many firms can meet or surpass the higher wages and attractive incentives to attract and retain workers, those that cannot do so –– more often than not, local and smaller firms –– will continue to struggle to fill positions.

Attracting Qualified Workforce Requires Long-Term Planning

It’s important to think long-term when drafting strategies to combat the lack of skilled workers to fill positions in construction. For AGC, that long-term picture includes revamping the way career opportunities are promoted to young people. “Too few schools offer classes in construction or expose students to the opportunities that exist in the field,” said the authors of the AGC report. They urge the federal government to boost funding for programs that provide students with both the skills and a clear path to successful construction careers.

Between infrastructure investments and CHIPS Act projects, green energy jobs and specialized labor, the need for addressing the skill gap is not going away any time soon. Members of ABC and respondents to the AGC/Autodesk survey indicate hiring is likely to continue to grow over the coming months, and layoffs are unlikely. Thus, it’s necessary for industry leaders to make strides toward productively addressing the issues contributing to the worker shortage.